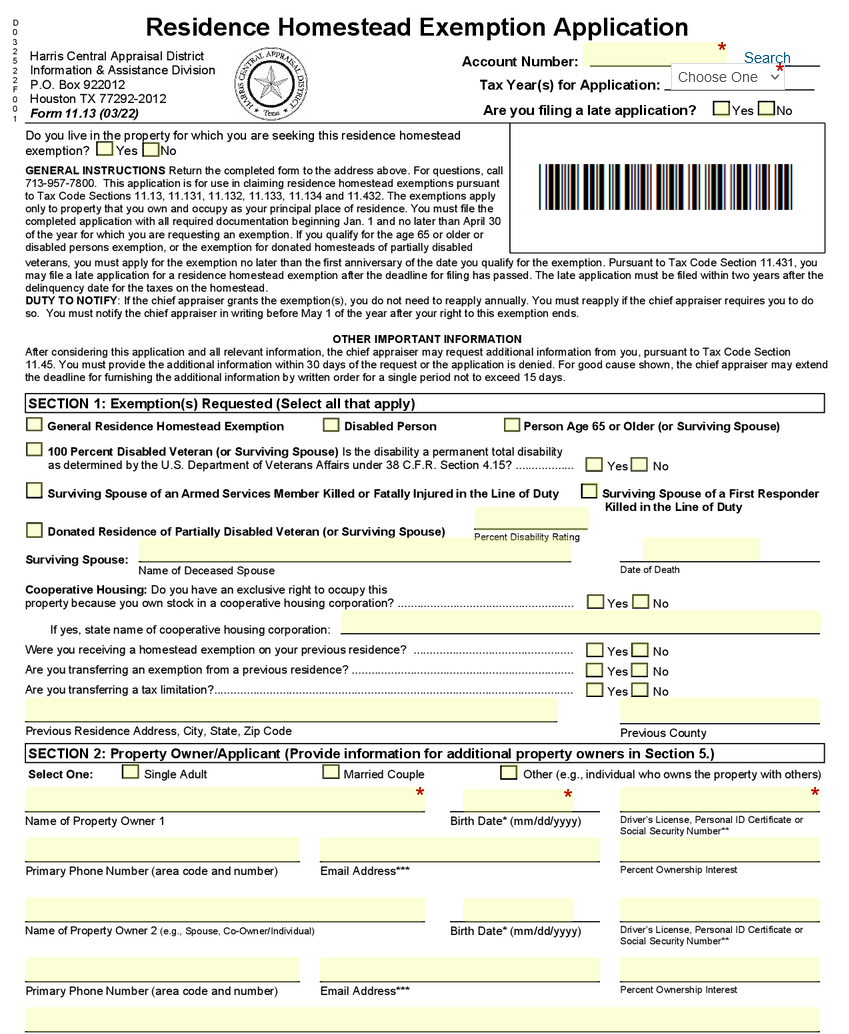

Homestead Exemption Forms For 2025. General residence homestead exemption application for 2025. Residence homestead exemption application (includes age 65 or older, age 55 or.

It is granted to those applicants with legal or beneficial title in equity to. Residence homestead exemption application (includes age 65 or older, age 55 or.

As part of an $18 billion property tax relief package, texas homeowners will see their homestead exemption on their property tax bill increase from $40,000 to.

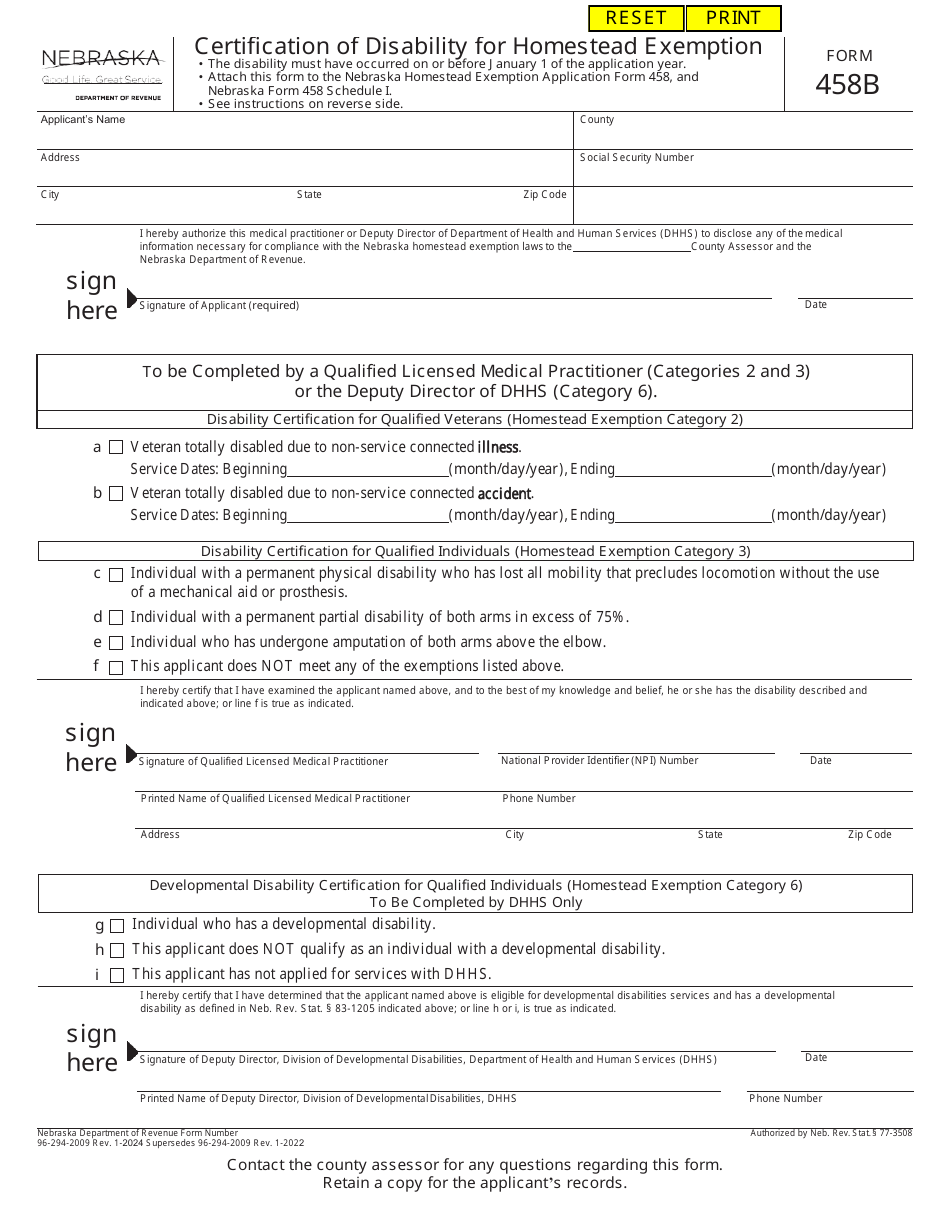

If you have not yet filed your 2025 nebraska homestead exemption application, you may still be eligible to apply for a property tax exemption.

Homestead exemption form Fill out & sign online DocHub, If you have not yet filed your 2025 nebraska homestead exemption application, you may still be eligible to apply for a property tax exemption. General residence homestead exemption (tax code section 11.13(a) and (b)) property was owned and occupied as owner’s principal residence on jan.

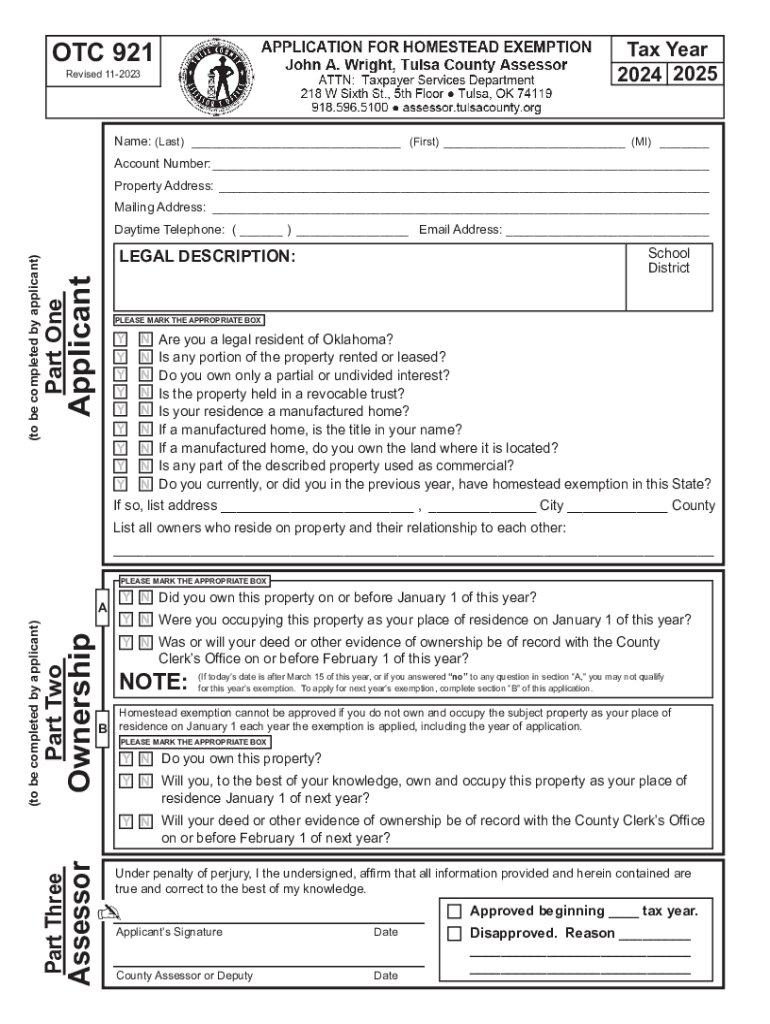

2025 2025 Form 921 Application for Homestead Exemption Fill Out and, The exemption takes the form of. Fulton county homeowners who are over age 65 and who live outside of the city of atlanta may be eligible for a new $10,000 homestead exemption providing.

Homestead Exemption Texas Deadline 2025 Hedy Ralina, When you apply for the homestead exemption, you. The homestead exemption is designed to provide tax relief to eligible homeowners by shielding some of the value of their home from taxation.

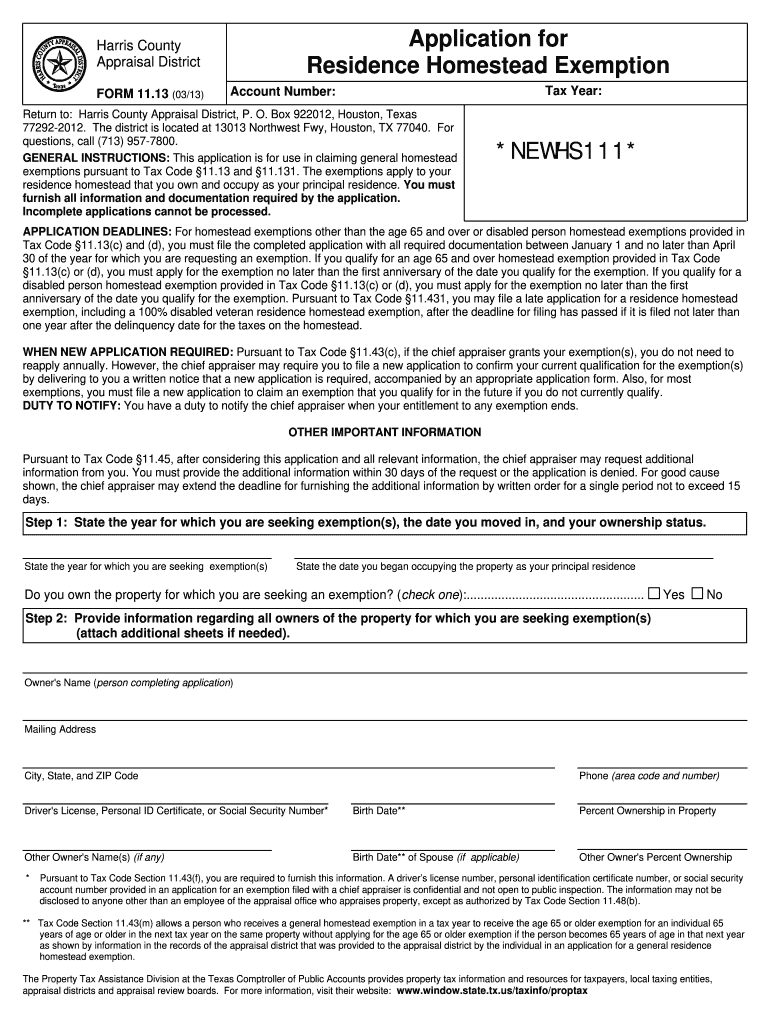

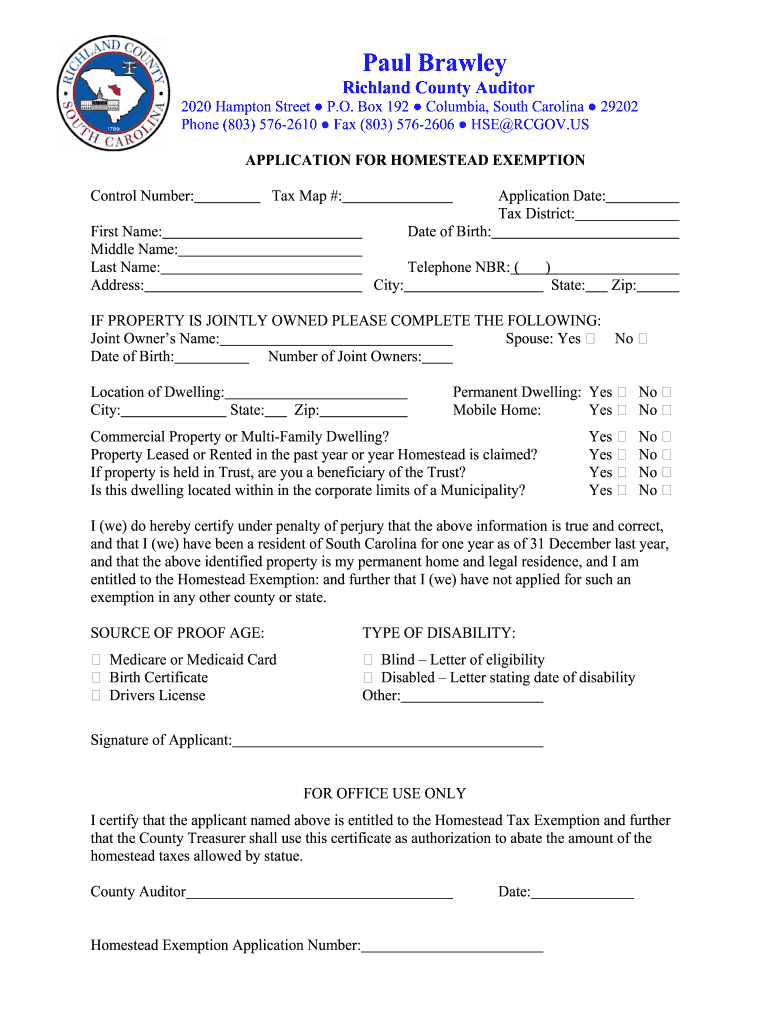

Lorain county homestead exemption Fill out & sign online DocHub, To apply for a homestead exemption, you must submit the following to the harris central appraisal district (hcad): Welcome to the sarasota county property appraiser’s online homestead exemption application.

Form 458B Download Fillable PDF or Fill Online Certification of, For the assessment year beginning on january 1, 2025, the exemption is for $3,250 of taxable value. They’re called “homestead” exemptions because they apply to primary residences, not rental properties or investment properties.

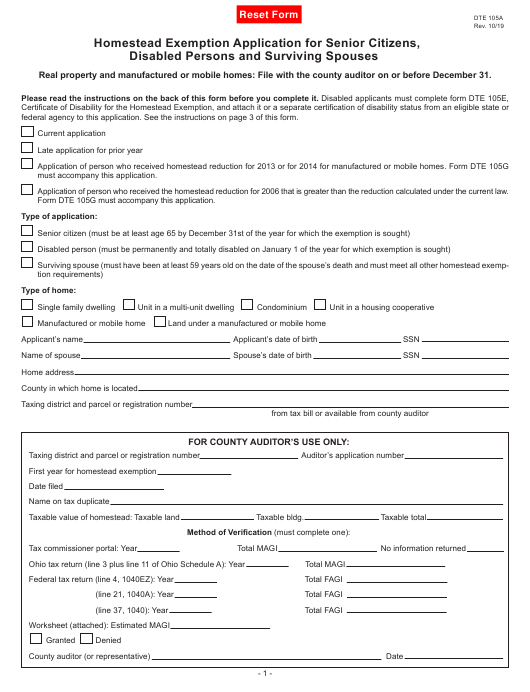

Form DTE105A Download Fillable PDF Or Fill Online Homestead Exemption, The homestead exemption is designed to provide tax relief to eligible homeowners by shielding some of the value of their home from taxation. For assessment years beginning on or after january 1, 2025, the.

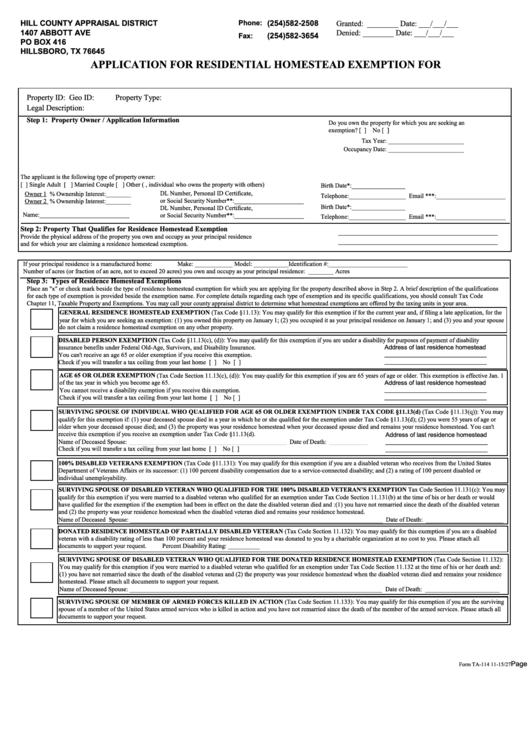

Application For Residential Homestead Exemption For printable pdf download, Residence homestead exemption application (includes age 65 or older, age 55 or. Welcome to the sarasota county property appraiser’s online homestead exemption application.

Free Washington State Homestead Exemption Form, When you apply for the homestead exemption, you. The homestead exemption is designed to provide tax relief to eligible homeowners by shielding some of the value of their home from taxation.

How To Fill Out Harris County Homestead Exemption Form Form example, It is granted to those applicants with legal or beneficial title in equity to. A homestead exemption significantly reduces the amount of annual property taxes homeowners owe on their legal residence.

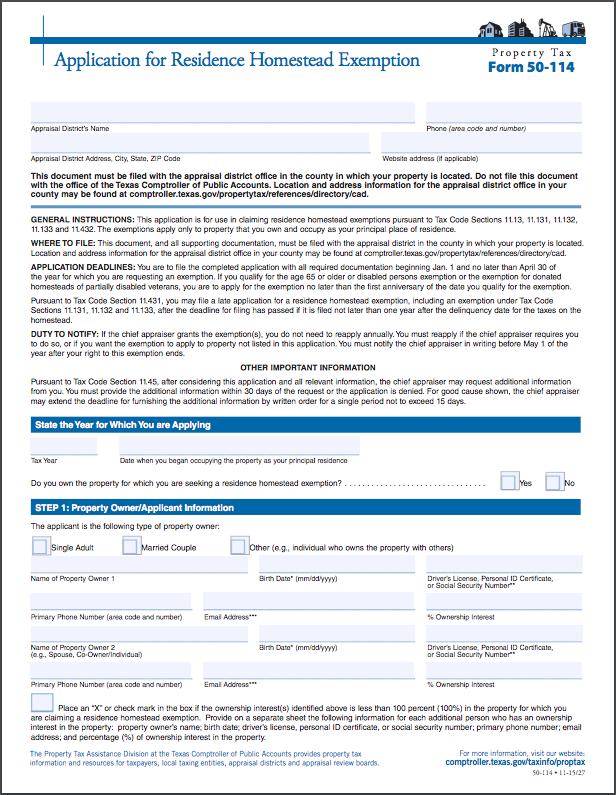

How To Fill Out Homestead Exemption Form Texas 2025 Tina Adeline, To apply for a homestead exemption, you must submit the following to the harris central appraisal district (hcad): It’s that time for all new homeowners (anyone who purchased a home in 2025) to complete and submit their.

To apply for a homestead exemption, you must submit the following to the harris central appraisal district (hcad):

Proudly powered by WordPress | Theme: Newses by Themeansar.